Either unregulated free markets work, or they don’t. Either a thing is the President’s responsibility, or it isn’t. You can’t have it both ways unless you’re inventing your own reality… Oh yeah, never mind.

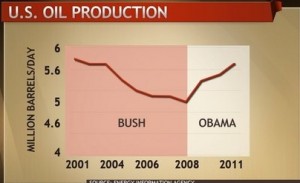

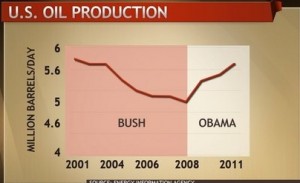

Okay, maybe we should mind a little… The GOP’s message is that Obama is responsible for high gas prices and he should do something about that. And that something is to “drill, baby, drill“. Unfortunately, those damned liberally biased facts stand in stark opposition to the GOP’s message. As the chart on the right shows, oil production under Obama has risen at a substantial rate, and contrasts markedly with the steady decline of production under George Bush. In fact, the number of oil rigs in production in the U.S. has reached a 24-year high, according to oil field services company Baker Hughes. In 2005, domestic production was 1.89 billion barrels. This year, experts say, production is expected to surpass 2 billion barrels.

Okay, maybe we should mind a little… The GOP’s message is that Obama is responsible for high gas prices and he should do something about that. And that something is to “drill, baby, drill“. Unfortunately, those damned liberally biased facts stand in stark opposition to the GOP’s message. As the chart on the right shows, oil production under Obama has risen at a substantial rate, and contrasts markedly with the steady decline of production under George Bush. In fact, the number of oil rigs in production in the U.S. has reached a 24-year high, according to oil field services company Baker Hughes. In 2005, domestic production was 1.89 billion barrels. This year, experts say, production is expected to surpass 2 billion barrels.

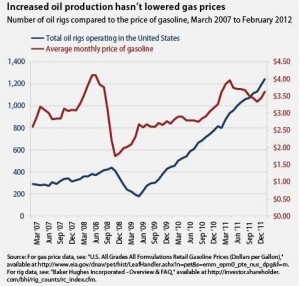

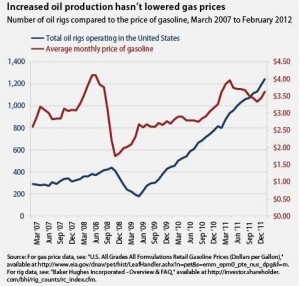

Further, there’s no correlation between domestic oil production and gas prices. The chart on the left shows instead that the two numbers seem to roughly track. If we assume (moronically) that correlation is the same as causation, the obvious policy would be to stop domestic production in an effort to bring prices at the pump down.

Further, there’s no correlation between domestic oil production and gas prices. The chart on the left shows instead that the two numbers seem to roughly track. If we assume (moronically) that correlation is the same as causation, the obvious policy would be to stop domestic production in an effort to bring prices at the pump down.

Another nail in the coffin of the failure to drill position is the U.S. Energy Information Administration report that the U.S. exported 430,000 more barrels of gasoline than it imported for the month of September. This is an historic change, because we’ve been a net importer of gasoline, mostly from Europe, since the 1960s. We are not domestically constrained on gasoline supply.

Another inconvenient truth is U.S. net petroleum imports have fallen to about 47% of the nation’s consumption, down from a record 60.3% in 2005, Energy Information Administration statistics show. It’s been 15 years since the nation’s reliance on foreign oil has been this low.

So does Obama deserve all the credit for this? No, absolutely not. While he’s called for ending the $40B in annual subsidies to big oil, so far the money flows unabated. While there was a brief moratorium on deep water drilling after the BP oil spill, that was long ago lifted. Obama subsequently opened up drilling in the Arctic to the howl of environmentalists, and also agreed to open leases for drilling off the eastern seaboard, despite his reputation on the right for shutting down oil exploration. Obama may not be responsible for the boom in production, but it’s not at all clear how you can claim he’s a hindrance to it. There might be a claim that he could do more to spur drilling, but there’s no evidence he’s done anything yet to impede drilling. If anything, his policies lean the other way.

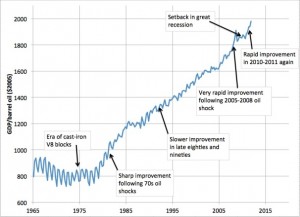

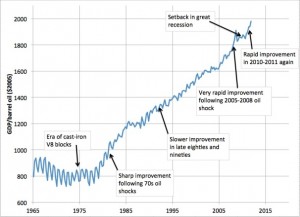

Meanwhile, in reality, the major reasons for increases in domestic oil production lie with recent advances in geologic imaging allowing accurate identification of underground oil deposits, as well as the development of new extraction techniques making previously unprofitable wells productive.

The impact of energy efficiency should also not be underestimated. Not only are our homes, cars, and appliances cleaner and greener, but advances in technology have reduced the need for travel. More of us are telecommuting to work, or using GoToMeeting instead of jumping on a plane.

The impact of energy efficiency should also not be underestimated. Not only are our homes, cars, and appliances cleaner and greener, but advances in technology have reduced the need for travel. More of us are telecommuting to work, or using GoToMeeting instead of jumping on a plane.

Hmmm… domestic production is up, domestic use is down, and gas prices are still rising. That doesn’t sound like the supply & demand model we learned about in school! But wait, I’ve heard rumors that the US is not the only country on the planet. Maybe there are other players here influencing the market.

It turns out that growing industrialized counties like China and India are consuming an ever larger portion of the global oil supply. In aggregate, the global demand is expected to barely keep pace with global production. So there’s minimal excess capacity in the market, and that helps keep prices high. Granted, additional production will definitely help this problem. However, if China and India continue growing at their current rate and eventually consume oil at rates approaching what we do in the U.S., the need will far outstrip the supply of oil on the entire globe. So long term, most of us have to find an energy alternative to oil anyway. The only way “Drill, Baby, Drill” solves this problem is if the US becomes entirely oil self-sufficient, and then detaches itself from the global oil markets. And that flies directly in the face of the GOP position on open, free, and unregulated markets. Can you imagine the cries when the law is passed that prevents Exxon from exporting?

And speaking of free markets, oil speculators are in no small part responsible for the current price spike. Almost 70% of the current oil commodities market is driven by speculators. Why is speculation driving prices up? Primarily, the speculation that there is an imminent military intervention in Iran that will dramatically impact the delivery of Mid-East oil. Meaning, the increased saber-rattling toward Iran is helping drive prices up by driving speculation of a coming supply crunch. Keep in mind that while Obama has offered stern warnings to Iran, the current GOP Presidential contenders (excluding Ron Paul) have all promised to attack Iran if they don’t fall in line to U.S. demands. Commodities speculation is fairly unregulated, and it seems highly unlikely the GOP would support such financial regulation. Meanwhile, their militaristic approach to foreign policy exacerbates fears that are driving the free market in the direction they claim to not want it to go.

Mitt Romney is on record saying that rather than bail out the auto industry, the market should just have been allowed to run its natural course. That’s what’s best for the markets and ultimately best for America. Why then, is it not best for the markets and best for America to let gas hit $5/gallon if that is the natural course of things? Why should the government intervene on gas prices?

If your mantra is, shut up and take your medicine while the markets sort it out, then shut up and take your medicine.

Last night, a majority of you, through your action or inaction, elected Trump. I don’t fully understand why, but it kinda doesn’t matter now. That’s done. Water under the proverbial bridge. No backsies. Besides, whatever your motivation, the reality is that you elected Trump’s policies and visions. Further, you swept in a single party to control the White House, Congress, and in short order, the Supreme Court. So there’s little to hinder Trump delivering on what he’s promised… and soon. After all, Trump has been very plain about how much will change on Day 1 or in the First 100 Days. Maybe that’s a bit of hyperbole, but he’s easily got 2 years of pretty unchecked reign to get his agenda on track. He’s got no excuses, so buckle up.

Last night, a majority of you, through your action or inaction, elected Trump. I don’t fully understand why, but it kinda doesn’t matter now. That’s done. Water under the proverbial bridge. No backsies. Besides, whatever your motivation, the reality is that you elected Trump’s policies and visions. Further, you swept in a single party to control the White House, Congress, and in short order, the Supreme Court. So there’s little to hinder Trump delivering on what he’s promised… and soon. After all, Trump has been very plain about how much will change on Day 1 or in the First 100 Days. Maybe that’s a bit of hyperbole, but he’s easily got 2 years of pretty unchecked reign to get his agenda on track. He’s got no excuses, so buckle up.