CORRECTION: The original article contained an assumption of 25m people currently at minimum wage. That number is incorrect in that it actually represents the number of workers below $11.50/hr that would be impacted by a new $10.10 minimum wage. This did, in fact make the math wrong. The article below has been changed to include more accurate numbers.

The ongoing political battle over minimum wage too often seems to lose site of the larger goal each side is trying to achieve. And further, I’m increasingly understanding that the stated goals are not too far apart. This leads me to believe that someone has an actual goal different from their professed goal, or that my math is just way the hell off.

The ongoing political battle over minimum wage too often seems to lose site of the larger goal each side is trying to achieve. And further, I’m increasingly understanding that the stated goals are not too far apart. This leads me to believe that someone has an actual goal different from their professed goal, or that my math is just way the hell off.

As Bill Maher alludes to in the depicted quote, the right is frequently on record as having a desire to reduce or eliminate safety net programs. This is also a goal of the left. The difference being that the right seems to want to eliminate the net on the premise the need will then go away, whereas the left wants to eliminate the need for the net so it can die of natural causes.

Let me start by asserting something I hope everyone can agree on. As a society, we will not simply remove the safety net and let any significant portion of the population wallow in abject poverty. While some may see this as an obvious humanitarian position, even the most pure-blood capitalist has to recognize that, historically, having a large, persistent, impoverished, and increasingly desperate economic underclass never ends very well for those who control the wealth and resources. To that end, there is an inherent balance between the government subsidizing low-skill workers through safety net programs and having private industry pay full freight for the labor they are using. Someone is going to pay for these folks.

My second assertion is that there is no ideological reason to keep the minimum wage at the current $7.25 rate. If you accept minimum wage as adding value to the economy and to society, then it should represent a living wage that would allow a worker to live without government supplements. If you fall on the side of free market capitalism, then there should be no minimum wage and the market should set the rate at whatever it will bear.

Third, let’s assume that the current minimum wage, in addition to current safety net supplements, are minimal but sufficient compensation for low-skill workers. Finally, let’s assume the CBO report (PDF) on the impact of raising the minimum wage to $10.10 is a reasonable predictor of the outcome.

Given these constraints, the cases to consider are an increased minimum wage at which workers’ dependence on the safety net would be lessened or eliminated, verses a natural wage floor that if lower than the current minimum wage would require an increase in safety net benefits just to keep workers even with where they are today.

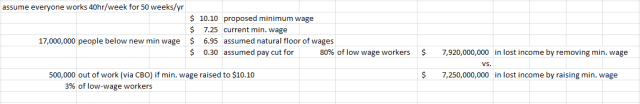

Now for the math: the CBO says there are 17m low wage workers (currently making below $10.10/hr), and as a result of raising the minimum to $10.10/hr, 500k (3%) would lose their jobs and the remainder would get a raise. As seen in the worksheet below, assuming the lost jobs are all at the current minimum wage end, the newly unemployed represent a $7.25b loss of wages.

In the other case, I think we can agree that given the current unemployment rate for low-skill workers that there is an excess of supply. This means the $7.25 minimum wage is holding the wage floor artificially high. Market forces should seek a lower wage, and I think we can say with confidence that absent a minimum wage law, the wages of the majority of low-skill workers would fall. For the model below, I somewhat generously assumed that 20% of workers currently at the minimum wage would retain that wage because their value to their employers warranted it. I also assumed that the actual wage for the remaining 80% would fall by only $0.30/hr, which is almost certainly a low number. Still, the resultant wage losses for the group amount to $7.92b.

In addition, the CBO estimates that 8m workers who are currently above the $10.10/hr rate would see a net positive gain from the ripple effect of a higher minimum wage. While not stated, presumably this group would be negatively effected by the ripple of the wage floor falling. (None of the 8m were included in this corrected analysis.)

In either case, we’ve assumed the government is on the hook to provide some form of substitute compensation to make up the loss for the effected workers. Clearly, it’s cheaper for the government to wholly pay for the unemployed 3% than to offset the loss of the 97%.

Further, the minimum wage increase should lessen the dependence on the safety net for the workers who get raises. Assuming workers only reduce their dependence by $600/yr, the result is a $7.92b savings that more than offsets the payments to the 3%. Given that Food Stamp benefits alone are about $1600/yr/person and EITC ranges from $500 to over $6k, recovering $600/employee seems pretty conservative. This is backed up by the CBO report that concludes for the raised minimum wage case that the impact on the federal budget would be a wash.

There is no obvious offsetting revenue stream for letting the market set the wage floor unless we assume a rise in corporate profits and increased revenue from corporate taxes. If this new tax revenue offsets the incremental safety net cost, then why not have the companies pay the money directly to their workers through wages rather than paying it in taxes and having the government redistribute it to those same workers?

All bleeding heart issues aside, I can’t see how raising the minimum wage is not a net economic benefit to society as a whole. Certainly it’s not a disaster as federal minimum wages have been around since 1938—a period during which the USA rose to be the preeminent economic power in the world. This does not prove causation, but does prove that prosperity is very possible with a minimum wage in place.

Further, economically speaking, having the government set a minimum wage is not different than a union or other collective bargaining organization setting a wage-price above what the natural unregulated non-unionized worker price would be.

It seems that advocating for the alternative to a living minimum wage necessarily admits some hidden ideological agenda. Perhaps the motivation is really to benefit individual companies rather than society. Perhaps the assumption that we wouldn’t financially marginalize chunks of our population is not valid. But it’s unclear how it can be rationalized to be about macroeconomic benefit to the country. Or maybe my math really (still?) is whacked. I’m happy to have the error in my ways pointed out, because I’m clearly missing something here.

http://www.cbo.gov/sites/default/files/cbofiles/attachments/44995-MinimumWage.pdf

Am I reading the wrong CBO report? The one I’m reading says that there are 16.5 million making less than 10.10. There are 7.6 million making less than $9.00. I think the number actually at minimum wage is less than 3 million. No point doing the numbers if I’m looking at the wrong report, so please let me know where the right one is.

I reread this this morning and just realized that you linked to the report in the text, and it is indeed the same report. So I’m going to admit that I might be reading it wrong, and I’m sure you’ll correct me if I’m wrong, but if I’m reading it right, that changes your numbers by around a magnitude of 10. So if your premise was that this was rock solid proof that there is a hidden ideological agenda from the right, now is it (hypothetically if my numbers are right) proof that the hidden agenda is on the left? That maybe some of the people pushing this don’t give a rats ass about helping the poor, that they are just trying to stay in power? This goes back to the hypothetical I asked you previously, if you can keep the poor poor and convince them the other side is keeping them there then you are guaranteeing their vote for years to come.

But even if you take the numbers as you have them, it still doesn’t make society better off. In your example, you’ve successfully redistributed money from employers to employees, but you haven’t created any more wealth. Actually you’ve reduced it by the output of 500,000 workers. (I said in my facebook post that GDP is not an accurate measure of happiness, but its about the best measure we have.) Are the employers going to just “make less money”? No, they are going to raise prices to cover the costs. There will be an inflationary ripple effect throughout the economy. You can artificially change the inputs, but prices will always move back toward their equilibrium. You can index minimum wage to inflation, but then you’re just a dog chasing his tail.

“Let me start by asserting something I hope everyone can agree on. As a society, we will not simply remove the safety net and let any significant portion of the population wallow in abject poverty”. I cannot agree with this. Reality conflicts with this notion. Raising the minimum wage is a recipe for reform, which leaves the corrupt capitalist machine and the owner class in power, changing nothing but the length of the struggle and the suffering of the poor. Reform-no. Revolution-yes.

My numbers were wrong, and I have admitted as much within and (I believe) corrected the original post. Thanks for keeping me on my toes. But while the case is not as strong, it still comes out in the same place (at least until you find another error).

I agree that raising the minimum wage doesn’t create more national wealth by itself. But CBO does assume that raising the minimum wage has a net effect of $2b going to low income households, who predominately will turn around and spend that money. In effect, this creates a $2b stimulus to the economy.

It’s less clear to me that this results in an inflationary ripple throughout the economy. There’s little reason any of this will push up the price of jet engines or iPads. They are not dependent on domestic low-skill labor. In the consumer goods space, I think any price increases will be contained by competition. Stores like Costco, Trader Joe’s, and QuikTrip are competing with Wal-Mart and K-Mart today and offer wages that would leave them unfazed by a jump to a $10 minimum wage. If Wal-Mart moves their prices too far, Costco will eat them for lunch.

With apologies, there were some numerical errors in the original post. They have been corrected…

Well Bill R., as I alluded to, allowing the creation of a large, impoverished, and desperate economic underclass will get you a revolution. But I do think most of us are hoping for a less brutal solution to the “corrupt capitalist… owner class” problem.

Hopeful but not optimistic.

No its still not right. If you are comparing the effect of getting rid of the current minimum wage. By your analysis you should be using 80% of the people at minimum wage. Not 80% of the workers affected by the new hypothetical minimum.

I don’t see why it would be restricted to only minimum wage workers. If raising the rate has a ripple effect upward to $11.50, why wouldn’t lowering the rate have a negative ripple effect on those above $7.25. The magnitude may be wrong, but I think the effect is clearly there.

I don’t remotely think the new wage floor would be $6.95. It would likely fall to well under $6. (This is admittedly speculation. I’d love to see a model of this.) That this would create downward pressure on the whole lower end of the wage scale to the tune of 15, 20, or 30 cents/hr seems entirely plausible.

So then the value of the the lost revenue from lowering minimum wage is dependant on what you are comparing it to? It’s different whether your comparing $9 than $10.10? That doesn’t make sense. Dropping 80% of the workers that are at min wag I can understand, but you really have to justify using that % for the wages above it.

The more assumptions you make, the less your model means.

No, the value of the lost revenue is dependent on how low the rate goes. The CBO model projects that the higher the rate is raised, the further the ripple extends into wage rates not directly impacted. Similarly, the lower the rate falls, the further the ripple extends.

For example, if the natural rate floor is $7.15 instead of $7.25, it would be surprising to find that had much impact on people making $8 or $9 an hour. If the floor is $4 all the interim rates from $4 to $7.25 are going to be filled with some workers, and I see no reason to assume all those workers will come from people currently making $7.25. It should (and CBO seems to suggest it would) fill from above that line as well.

Given that I’ve ignored the 8m workers potentially impacted above the $10.10 line and I’m only assuming an average decrease of 30 cents/hr, I think the assumptions are adequately conservative.

Seriously, the only thing this proves to me is that if you make bad enough assumptions you can prove anything. You really have no basis for using the numbers you use. Its understandable that raising the minimum wage is going to raise the wage of others. Shift supervisors are going to make more than the entry level people. It’s not clear how that works in reverse. There might be some affect, but assuming 80% of the ‘low wage’ people are going to be affected is just nuts.

Then I’m trying to follow the logic the rest of the way through, and I’m having trouble.

“Clearly, it’s cheaper for the government to wholly pay for the unemployed 3% than to offset the loss of the 97%.”

Did you tell us what the loss of the 97% is?

“Assuming workers only reduce their dependence by $600/yr, the result is a $7.92b”

So you are assuming 13,200,000 save $600 each? Where’s that number come from? The cbo says just 19% of the 31B in extra revenue goes to people below the poverty threshold, but we’re going to get more back in savings from the safety net? If that’s the case I don’t think they’d take the extra money.

“There is no obvious offsetting revenue stream for letting the market set the wage floor…”

Did you account for the increased employment?

So nice try, but this is really just speculation anyway.

First of all, it doesn’t matter How high you make the minimum wage when the largest number of Americans since the Great Depression don’t have jobs anyhow. Jobs need to be created, then those who actually have skills can go back to work and add to the income of our nation rather than adding to those who need the “safety net”.

Minimum wage was NEVER intended to be a “living wage” for anyone. It was for entry level jobs, for teenagers, and for retirees looking for something to do.

Wage slaves are still slaves. Elimination of the parasitic owner class will allow the workers to enjoy the full benefits of their labor. Anything else is unacceptable. No sympathy for the business man.

I think there was a tone in my previous comments that I’m not happy with. Rigorous discussion of the issues is good and shouldn’t be hampered by a tone which discourages discussion. So calling your assumptions bad or nuts isn’t right and I apologize for that. They are totally inconsistent with what I think would happen, but I can’t claim to have a crystal ball either. The truth of that matter is that there is very little empirical evidence as to what happens when you eliminate a minimum wage. It rarely has happened. So the sky is the limit as far as theories are concerned.

That being said I have a question for you. Your claim is that it is OK to lose 500,000 jobs as long as society as a whole benefits. Would your argument change at all if you found out the 500,000 were predominantly black or minority? Purely hypothetical, I have no data either way.

Brian, I do appreciate you keeping the conversation civil. And I do acknowledge that there’s a lot of conflicting information and opinion on the topic and that we probably can never accurately model economic futures as there is such a high presence of human behavior that influences the outcome.

To address your hypothetical, no, for me the demographic makeup of the newly unemployed doesn’t matter. I’m assuming, of course, that minorities would not be specifically targeted. That would be wrong. But if it was handled fairly and that was just the outcome, then it is what it is.

I would also add that I do not envision the 500k impacted workers to be permanently unemployed. One of the objectives here would be economic stimulus (and yes, I know you don’t buy into that). In that case, 500k would be absorbed by 2-4 months of modest job growth in a good economy.

That’s an interesting answer. Do you think the fact that the black unemployment rate is usually twice the white unemployment rate is evidence that your program might disproportionately help whites? If there is that possibility should the govenment do its due diligence and figure it out?

I would say my opinion on economic stimulus doesn’t really matter. The CBO says there is a stimulus effect and its already included in its numbers. Thinking there is going to be more stimulus is misreading the report.

What I really would like to know is your timeline. You claim that someone who is against minimum wage has an ulterior motive, profit, while I’m suggesting that at least some of the people who are for minimum wage also have an ulterior motive, political power. My timeline shows the economics profession always had reservations about the efficacy of the minimum wage. They produced reams of empirical evidence to back their case. The pro MW crowd pushed for raises in spite of this evidence. It wasn’t until the 90’s when Krueger and Card came out with their study that there was any empirical evidence at all in favor of MW. And much like your first paragraph, they seem to be happy with obfuscation of the topic. So what is your timeline? Explain your theory in historical context.

Well, I at least have to give you credit for originality. This is the first I’ve seen of pro MW people being accused of being motivated by racism and hunger for political power through worker oppression.

Well at least this is returnng to civil conversation, but reading this is like watching congress work… Or better yet not work. Talk about who’s right and who’s wrong enough and it ends up in talking in circles where I think the original arguments are way lost in the shuffle. I’ll have to drag myself out of the weeds and go read something interesting. Economics isn’t doing it for me.

http://econlog.econlib.org/archives/2014/03/being_sendhil_m.html

Key Quote: After moving to Los Angeles in 1980, Mullainathan left high school without graduating and went to Clarkson University…

I think I know somebody else who was at Clarkson then.

http://www.minimumwage.com/2012/03/unequal-harm/

I think Obama is going to wind up suing himself for the disparate impact of minimum wage.

The math all looks alright to me, but I think you are leaving some things out of the discussion. Raising the minimum wage will send the bigger numbers to the employees, but then the employers will take either one or a combination of steps to ensure the loss is not imposed on them. They will raise prices, reduce benefits, layoff workers, bring in technology to replace workers or ensure they do not need to hire additional as they expand. These things will play a huge factor in this and can not be disregarded. The numbers will be bigger, but the value will remain constant, because the economy will adjust to the mandated increase and so everything in the market will increase roughly at the same percentage.

What you say may well happen. And that would be a great outcome. Keep in mind that a healthy economy is essentially one where money is moving.