CORRECTION: The original article contained an assumption of 25m people currently at minimum wage. That number is incorrect in that it actually represents the number of workers below $11.50/hr that would be impacted by a new $10.10 minimum wage. This did, in fact make the math wrong. The article below has been changed to include more accurate numbers.

The ongoing political battle over minimum wage too often seems to lose site of the larger goal each side is trying to achieve. And further, I’m increasingly understanding that the stated goals are not too far apart. This leads me to believe that someone has an actual goal different from their professed goal, or that my math is just way the hell off.

The ongoing political battle over minimum wage too often seems to lose site of the larger goal each side is trying to achieve. And further, I’m increasingly understanding that the stated goals are not too far apart. This leads me to believe that someone has an actual goal different from their professed goal, or that my math is just way the hell off.

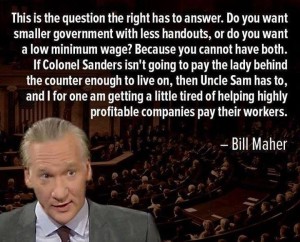

As Bill Maher alludes to in the depicted quote, the right is frequently on record as having a desire to reduce or eliminate safety net programs. This is also a goal of the left. The difference being that the right seems to want to eliminate the net on the premise the need will then go away, whereas the left wants to eliminate the need for the net so it can die of natural causes.

Let me start by asserting something I hope everyone can agree on. As a society, we will not simply remove the safety net and let any significant portion of the population wallow in abject poverty. While some may see this as an obvious humanitarian position, even the most pure-blood capitalist has to recognize that, historically, having a large, persistent, impoverished, and increasingly desperate economic underclass never ends very well for those who control the wealth and resources. To that end, there is an inherent balance between the government subsidizing low-skill workers through safety net programs and having private industry pay full freight for the labor they are using. Someone is going to pay for these folks.

My second assertion is that there is no ideological reason to keep the minimum wage at the current $7.25 rate. If you accept minimum wage as adding value to the economy and to society, then it should represent a living wage that would allow a worker to live without government supplements. If you fall on the side of free market capitalism, then there should be no minimum wage and the market should set the rate at whatever it will bear.

Third, let’s assume that the current minimum wage, in addition to current safety net supplements, are minimal but sufficient compensation for low-skill workers. Finally, let’s assume the CBO report (PDF) on the impact of raising the minimum wage to $10.10 is a reasonable predictor of the outcome.

Given these constraints, the cases to consider are an increased minimum wage at which workers’ dependence on the safety net would be lessened or eliminated, verses a natural wage floor that if lower than the current minimum wage would require an increase in safety net benefits just to keep workers even with where they are today.

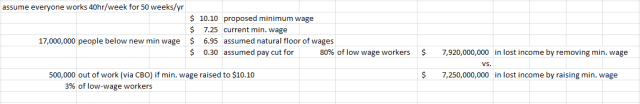

Now for the math: the CBO says there are 17m low wage workers (currently making below $10.10/hr), and as a result of raising the minimum to $10.10/hr, 500k (3%) would lose their jobs and the remainder would get a raise. As seen in the worksheet below, assuming the lost jobs are all at the current minimum wage end, the newly unemployed represent a $7.25b loss of wages.

In the other case, I think we can agree that given the current unemployment rate for low-skill workers that there is an excess of supply. This means the $7.25 minimum wage is holding the wage floor artificially high. Market forces should seek a lower wage, and I think we can say with confidence that absent a minimum wage law, the wages of the majority of low-skill workers would fall. For the model below, I somewhat generously assumed that 20% of workers currently at the minimum wage would retain that wage because their value to their employers warranted it. I also assumed that the actual wage for the remaining 80% would fall by only $0.30/hr, which is almost certainly a low number. Still, the resultant wage losses for the group amount to $7.92b.

In addition, the CBO estimates that 8m workers who are currently above the $10.10/hr rate would see a net positive gain from the ripple effect of a higher minimum wage. While not stated, presumably this group would be negatively effected by the ripple of the wage floor falling. (None of the 8m were included in this corrected analysis.)

In either case, we’ve assumed the government is on the hook to provide some form of substitute compensation to make up the loss for the effected workers. Clearly, it’s cheaper for the government to wholly pay for the unemployed 3% than to offset the loss of the 97%.

Further, the minimum wage increase should lessen the dependence on the safety net for the workers who get raises. Assuming workers only reduce their dependence by $600/yr, the result is a $7.92b savings that more than offsets the payments to the 3%. Given that Food Stamp benefits alone are about $1600/yr/person and EITC ranges from $500 to over $6k, recovering $600/employee seems pretty conservative. This is backed up by the CBO report that concludes for the raised minimum wage case that the impact on the federal budget would be a wash.

There is no obvious offsetting revenue stream for letting the market set the wage floor unless we assume a rise in corporate profits and increased revenue from corporate taxes. If this new tax revenue offsets the incremental safety net cost, then why not have the companies pay the money directly to their workers through wages rather than paying it in taxes and having the government redistribute it to those same workers?

All bleeding heart issues aside, I can’t see how raising the minimum wage is not a net economic benefit to society as a whole. Certainly it’s not a disaster as federal minimum wages have been around since 1938—a period during which the USA rose to be the preeminent economic power in the world. This does not prove causation, but does prove that prosperity is very possible with a minimum wage in place.

Further, economically speaking, having the government set a minimum wage is not different than a union or other collective bargaining organization setting a wage-price above what the natural unregulated non-unionized worker price would be.

It seems that advocating for the alternative to a living minimum wage necessarily admits some hidden ideological agenda. Perhaps the motivation is really to benefit individual companies rather than society. Perhaps the assumption that we wouldn’t financially marginalize chunks of our population is not valid. But it’s unclear how it can be rationalized to be about macroeconomic benefit to the country. Or maybe my math really (still?) is whacked. I’m happy to have the error in my ways pointed out, because I’m clearly missing something here.