Treasury Secretary Tim Geithner sent a letter to Congress last week in which he laid out the dire economic consequences should the debt ceiling not get raised in the next month or so. This alarm was not shared by The Economist, who pointed out that the Treasury Department still has several cards it could play to keep us from colliding with the ceiling until about August. Piling on, Moody’s made noises this week that if Uncle Sam doesn’t get his debt under control, he might lose his most favorable AAA credit rating. Meanwhile, House Republicans are demanding they will not entertain raising the ceiling unless they get significant spending reductions. And for good measure, add to the mix a new poll showing 71% of the public is opposed to raising the debt ceiling.

Does your brain hurt yet? It should. The likelihood is that the 71% public opposition to raising the ceiling is rooted in trying to simplify this mess in your aching brain down to the notion that more debt is a bad thing. While there’s truth to that, constraining the debt ceiling may be the wrong lever to use to achieve that objective.

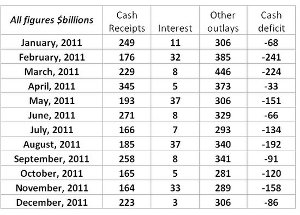

First, let’s be clear about something. Debt ceiling or not, the USA is extremely unlikely to default on its debt. The impact of default would make the 2008 economy crash look like a minor hiccup. The ensuing global catastrophe would hurt currency values as well as lending rates across the private and public sectors, and would leave a permanent scar on the US economy. Avoiding default merely means paying off our existing debt on schedule and not borrowing over our limit. As the chart to the left shows, keeping pace with our interest payments given our projected income isn’t at all unreasonable. But it does mean the federal budget will need to shave about $1.5 trillion from its planned spending this year. That’s not a haircut as much as an amputation, and without any anesthetic.

This brings us to Moody’s concern. While some are citing the threat to our credit rating as evidence we need to stop borrowing and pay off our debt, the reality is much less draconian. Moody’s would be quite content if we just looked like we had a plan for eventually paying off our debt. However, they note that we are saddled with escalating medical costs, unfunded military adventures, deteriorating infrastructure, and a political body who adamantly refuses to raise additional revenue through taxes. They are merely pointing out that this is not a sustainable path—and they are absolutely correct.

The common thread here is that we need a solid believable plan to get our debt under control. It doesn’t need to eliminate the current debt or even reduce future borrowing. We just need to walk a plausible path that leads to eventual stability.

Is the GOP helping then by using the ceiling as a lever to reduce spending? Does capping the debt ceiling help us get on that financial yellow brick road? Not really. Refusing to move the ceiling is like calling the bank to have them reduce your credit limit because you can’t control your spending. Yes, it forces you to not spend more, but it also causes the bank to rethink your credit worthiness. That may result in higher interest rates and/or your inability to get credit when you really do need it.

If Congress refuses to move the ceiling, our creditors will take that as a bad sign with regard to our ability to manage our finances. It won’t matter that we don’t default. It will still negatively impact the rates we pay to finance our current debt. And because almost all rates in the private sector are tied to T-bills, the higher rates will ripple into the rates paid by individuals and businesses as well. This helps no one, except maybe the Chinese and others holding our debt.

Getting our federal finances in order is essential, but the debt ceiling is the wrong tool to get that done.