It is said that no one escapes death and taxes, and certainly neither are popular. In the current political climate there is much gnashing of teeth over taxes. Mostly because we’ve pretty much exhausted our collective political angst over death during the healthcare debate.

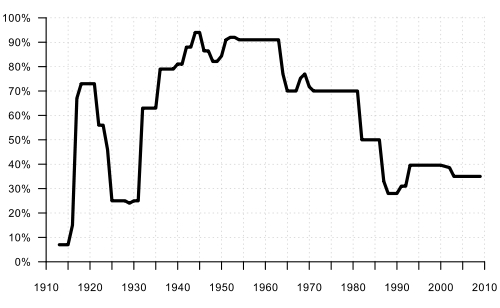

The prevailing wisdom is that taxes are too high and we must reduce them to provide relief for families and to provide for investment in small businesses and other economic growth factors. But that “wisdom” defies the facts at hand. Granted, no one like paying taxes, but tax rates are currently lower than at any time since World War II. Under Obama, the first tax bracket has been reduced to 10%. Even the second bracket of 15% is essentially the same or lower than the first bracket has been in 50 years (excepting a brief dip under Reagan). Meanwhile, the top bracket is ridiculously lower than at almost any time since 1942.

But the pain is real. Families struggle to make ends meet, and this was true even before the most recent recession and the large unemployment numbers. Why can’t middle class America, at least the ones with jobs, comfortably make ends meet?

But the pain is real. Families struggle to make ends meet, and this was true even before the most recent recession and the large unemployment numbers. Why can’t middle class America, at least the ones with jobs, comfortably make ends meet?

While taxes are a convenient demon, as we see from the data, they’re a false one. Taxes aren’t hurting us. However, there has been a very real erosion in purchasing power in the average American home. If you compound the Consumer Price Index from 1990 to 2008, your income would need to have risen by 75% over that 18 year span just to be able to live at the same level now you did back then. But average household income across that same period only rose 60%. And that doesn’t even take into account the increase in the number of two-income households over that same period. In many cases there are multiple people or people holding down multiple jobs just to get up to that 60% mark.

So yes, there is a definite reality to the feeling that you are working for less. But it’s not Uncle Sam that’s killing you. At least not the IRS part.